Real-time Fraud Detection for Fintech

Built ML-powered fraud detection system preventing ₹50L+ in fraudulent transactions monthly.

Fraud Prevented

Monthly savings

False Positives

Reduction

Response Time

Per transaction

System Uptime

Availability

!The Challenge

A growing digital payments startup was losing money to increasingly sophisticated fraud attacks. Their rule-based system couldn't keep up with evolving fraud patterns.

The situation: - ₹15-20L monthly losses to fraud - High false positive rate (8%) blocking legitimate transactions - New fraud patterns emerging weekly - Customer complaints about blocked genuine payments - Regulatory pressure to improve security

Our Solution

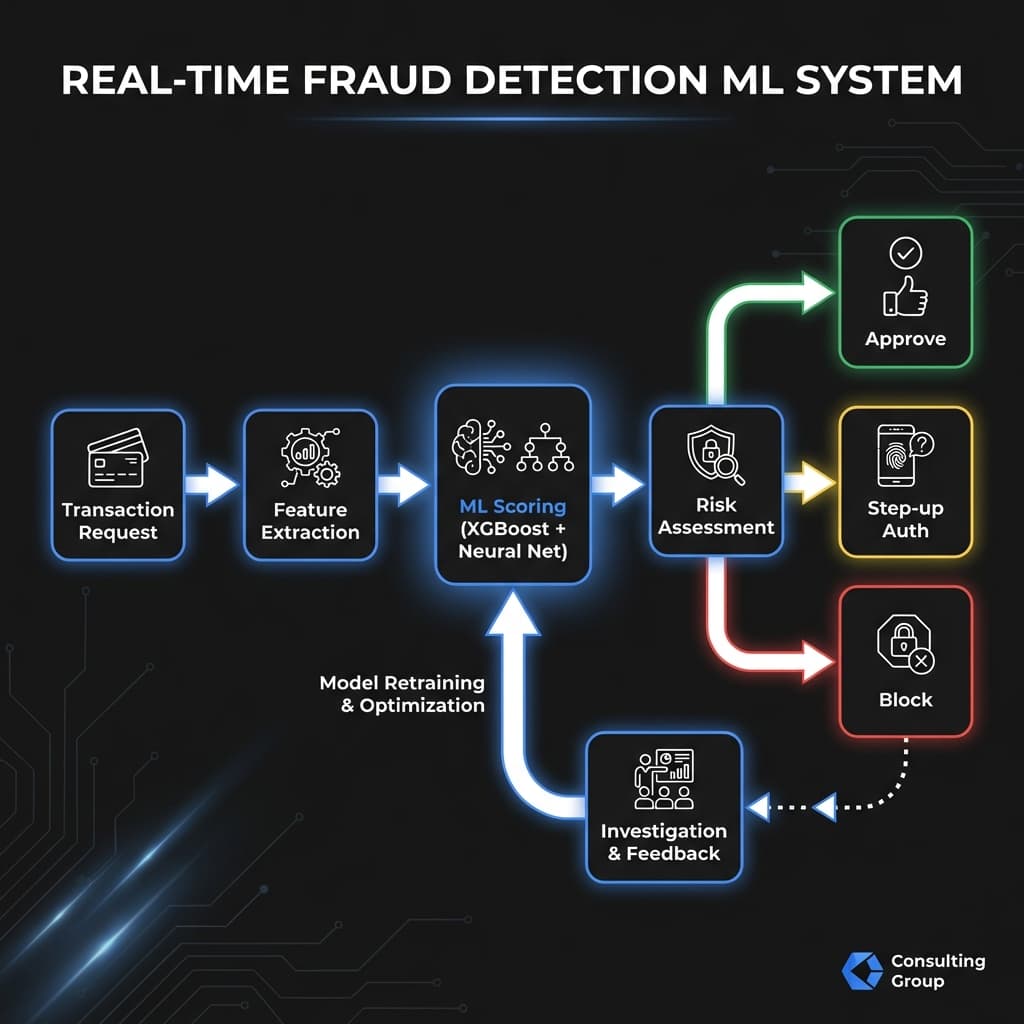

We built a real-time ML-powered fraud detection system that learns and adapts to new patterns.

Multi-Layer Detection

- Behavioral biometrics (typing patterns, device fingerprinting) - Transaction pattern analysis (velocity, amount, merchant categories) - Network analysis (device graphs, relationship mapping) - Ensemble ML models with XGBoost, Neural Networks, and Isolation Forests

Real-time Scoring

- Sub-50ms scoring for every transaction - Dynamic risk thresholds by transaction type - Step-up authentication for medium-risk transactions - Automatic blocking for high-risk patterns

Continuous Learning

- Daily model retraining on new fraud patterns - Feedback loop from investigation team - A/B testing of detection strategies

Fraud Detection Architecture • Click to enlarge

Results & Impact

Technologies Used

Want Similar Results for Your Business?

Let's discuss how we can apply our expertise in financeto solve your unique challenges.